December 18, 2025

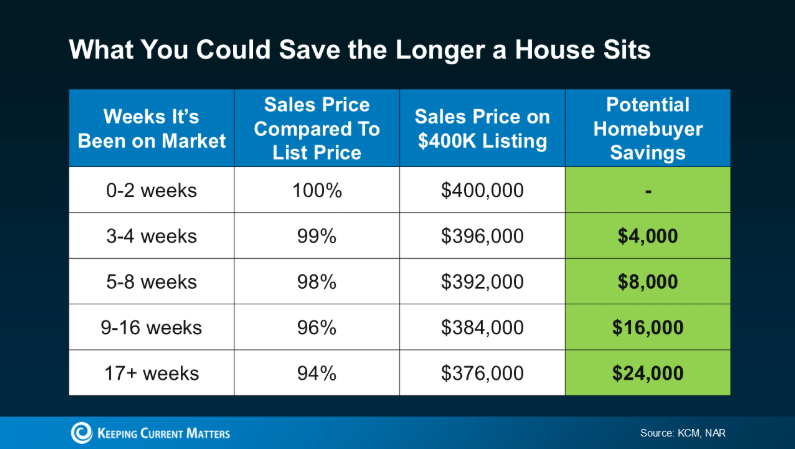

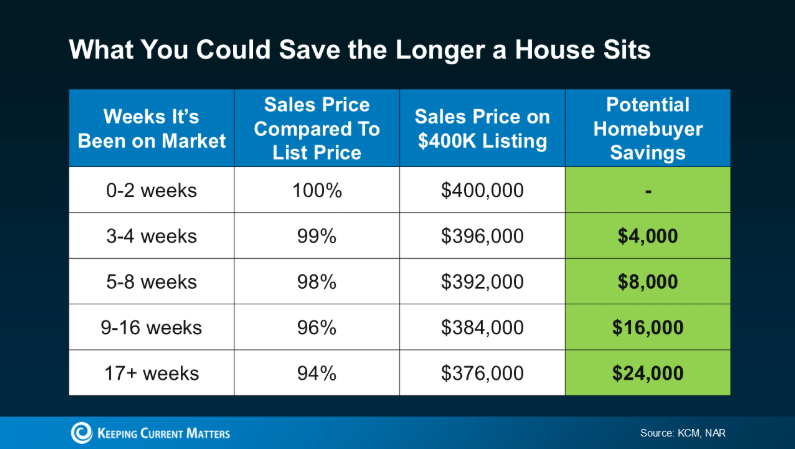

Want to know how to find the best deal possible in today’s housing market ? Here’s the secret. Focus on homes that have been sitting on the market for a while. Because when a listing lingers, sellers tend to get more realistic – and, more willing to negotiate. And that’s where the savviest buyers are finding homes other buyers overlook. The Opportunity: 1 in 5 Homes Has Had a Price Cut This Year According to Realtor.com , about 1 in every 5 listings (20.2%) have dropped their asking price at least once. And while so many things in today’s housing market vary by region, that number is consistent throughout the country. That tells you one thing… No matter where you live, there’s a chance to score a better deal. You just need to know where to look. And that’s where your agent comes in. The Tactic: Target Homes That Have Been Sitting the Longest Your agent can help you identify which homes have been on the market the longest. Those are the ones where you’re more likely to get a discount. That’s because the seller may be getting frustrated their house hasn’t sold yet, so they’re more willing to play ball. And since a lot of buyers steer clear of homes that aren’t selling, you may be the only offer they get. So, you can lean in and push for a better deal. As Realtor.com explains: “Less competition means fewer bidding wars and more power to negotiate the extras that add up: closing cost credits, home warranties, even repair concessions . . . these concessions can end up knocking thousands of dollars off the price of a home .” And they’re not the only ones calling out the opportunity you have right now. Bankrate also says: “During the quieter fall and winter months, when fewer prospective buyers are shopping, home sellers may be more willing to lower their prices, or offer concessions, to attract those prospective buyers who are still looking. ” And the proof is in the data. The National Association of Realtors (NAR) shows a clear pattern: the longer a home stays on the market, the lower it tends to sell for compared to the original asking price.