Lowering Premiums For Your Staten Island Real Estate Flood Insurance

Lowering Premiums For Your Staten Island Real Estate Flood Insurance

You can lower your flood insurance premiums lowered by having a SURVEYOR assess you property and declare it elevated. By using this process, you may be able to potentially save yourself a considerable sum on flood insurance premiums on your Staten Island real estate.

Detailed instructions can be found here National Flood Insurance Program Elevation Certificate and Instructions here.

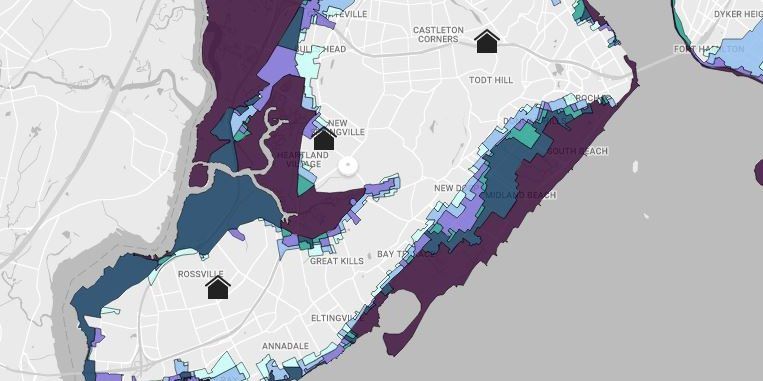

Hurricanes Sandy and Irene have taught a very painful lesson to homeowners that live in Staten Island flood zones, and those without flood insurance were left wondering whether it is worth the premiums. Homeowner’s insurance does NOT provide coverage for damages as a result of rising water levels from the ocean, rivers, lakes or streams. In many cases, you are required to acquire flood insurance through the National Flood Insurance Program administered by FEMA, otherwise a lender will not fund the mortgage.

You can find the particular flood map for your Staten Island property here

A very interesting article from Curbed NY detailing the government,s “managed retreat” efforts to combat flooding from climate change currently underway in several neighborhoods across Staten Island can be found here.